Acknowledging public transportation is at a tipping point, TransitTech offers to transform traditional transit players into next gen mobility providers

Mobility landscape has been widely disrupted over the last decade. In urban areas new on-demand mobility services (e.g., ridesharing, shared micro-mobility) have emerged as alternatives to public transportation and private vehicles. Yet, innovation has mainly transformed private B2C mobility, with limited collaboration between new private players and cities & PTOs/PTAs. As a result, these services have shown both economic difficulties and limited to negative impacts on societal, social, and environmental issues. In suburban and rural areas, transit patterns have also changed. Seeking flexibility and convenience, public transit riders have more and more neglected traditional fixed-route public transportation networks for other individual modes of transportation.

In this context, cities and PTOs/PTAs have started to understand the urgent necessity to modernize traditional public transportation. On one side, customers are now expecting on-demand, flexibility and convenience for every mode of transportation, including PT. On the other side, PTOs/PTAs are looking to find cost-efficient ways to modernize their networks in a context of reduced disposable investments and predictability of demand exacerbated by the covid-19 crisis. Moreover, cities are acknowledging the role of transportation in promoting sustainability, accessibility and equity.

Unlike private B2C mobility providers addressing cities and citizens’ needs by “outsourcing” traditional transportation, TransitTech providers acknowledge the key role PTOs/PTAs play in the modernization and transformation of mobility, by providing them with a software platform to optimize transportation networks by maximizing occupancy and increasing flexibility of public transport services, while simplifying operations.TransitTech software is a high potential and high margin market

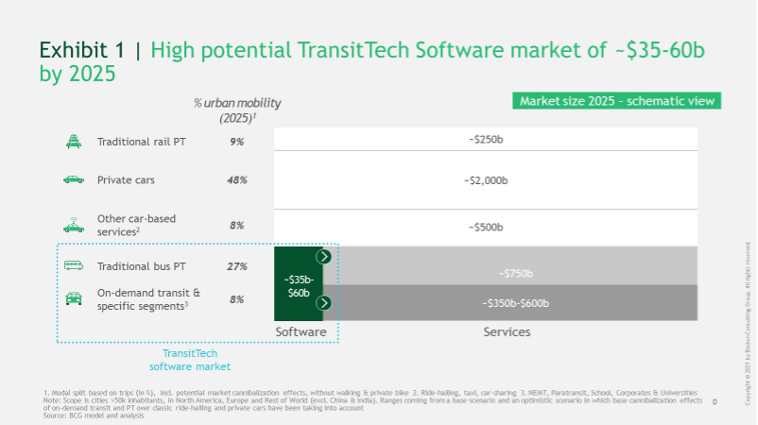

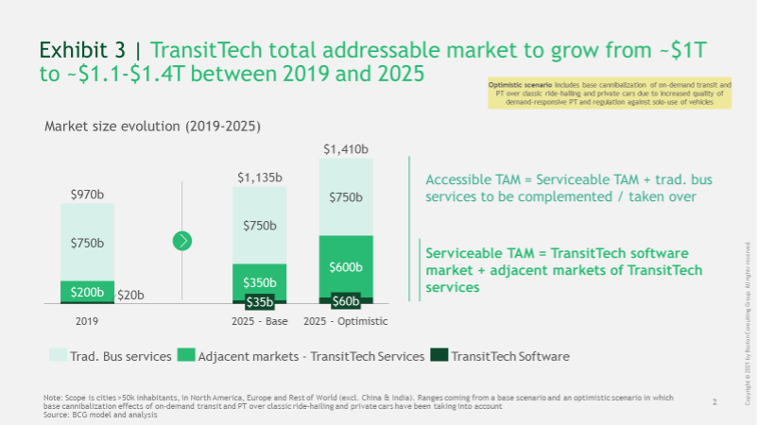

TransitTech is providing PTOs, PTAs, municipalities, but also corporations, schools/universities, with cost-efficient end-to-end technologies to modernize traditional transport across all mobility verticals (e.g., PT, paratransit, NEMT, shuttles). These solutions range from complex yet agile planning and design tools, fleet management and dispatch software and algorithms for on-demand transit services, routing automation and optimization solutions for traditional bus lines, to the integration of multiple mobility services on a single end-user platform. Global TransitTech software addressable market is expected to grow from ~$20b in 2019 to ~$60b in 2025, supported by PTOs/PTAs’ regained control over future urban mobility and increasing regulations towards shared mobility vs. single-occupancy vehicles. In addition, two major evolutions could further boost the market. On one side, potential market expansion towards providing smart flexibilization and fleet utilization solutions to other car-based mobility services could see TransitTech providers expand their spectrum of customers. On another side, growing stronger regulations against private vehicles in dense areas, are likely to drastically increase the modal share of public transportation and thus increase the size of the total market. Furthermore, key success factors on this fast-growing market will lay first in the ability of covering the entire value chain and developing a comprehensive set of tools to plan, optimize and operate transit systems enabling them to transform into efficient digital networks. Second, to guarantee strong revenue visibility and high margin, winners will need to provide their SaaS solution while adopting a native collaborative approach with regards to PTOs/PTAs to ensure product specifically fits their needs.

Furthermore, key success factors on this fast-growing market will lay first in the ability of covering the entire value chain and developing a comprehensive set of tools to plan, optimize and operate transit systems enabling them to transform into efficient digital networks. Second, to guarantee strong revenue visibility and high margin, winners will need to provide their SaaS solution while adopting a native collaborative approach with regards to PTOs/PTAs to ensure product specifically fits their needs.

Core TransitTech software market opens-up new opportunities in subsequent markets

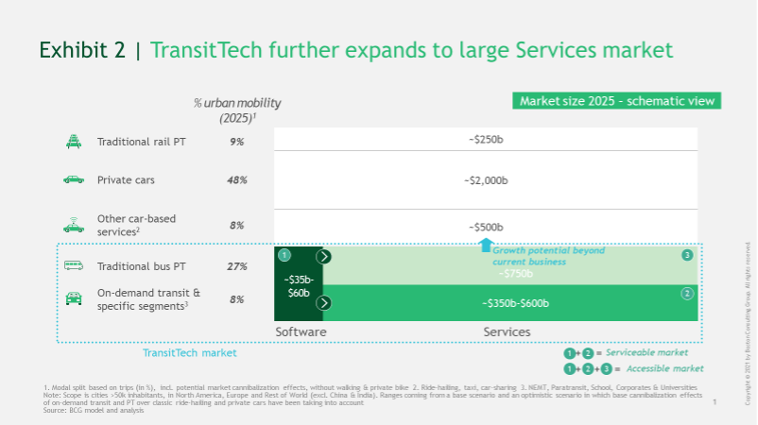

Beyond TransitTech software, TransitTech software providers can further support their customers by offering services for those seeking a comprehensive solution. For on-demand transit services, players can for instance provide the full range of mobility services (e.g. vehicle supply, fleet management, insurance, etc.). Beyond supporting operations, new opportunities also emerge by enabling PTAs/cities to modernize/innovate on marketing, advertising & sponsorship. In total, these subsequent service markets are estimated to grow from ~$200b in 2019 to ~$600b in 2025, representing tremendous incremental opportunities despite lower profitability than the TransitTech software market. Beyond that, TransitTech could even further extend to an additional segment of the ~$750b market of services for traditional bus PT by providing enhanced digital solutions.

.png?width=71&height=47&name=Sioux%20Falls%20Webinar%20(6).png)

%20(1)%20(1).png?width=71&height=47&name=Service%20Design%20Blog%20(2)%20(1)%20(1).png)